The iron ore magnate made a splash buying S. Kidman & Co with Chinese partners. But a flurry of property sales has Australia’s other billionaires paying attention.

Article by Tansy Harcourt courtesy of the Australian.

When Australia’s richest person starts moving hundreds of millions of dollars worth of agricultural chess pieces, the country’s other billionaires pay attention.

So then the Forrests’, the Holmes a Courts’, and the Joe Lewis’ of the land will be watching closely as Gina Rinehart sells significant cattle properties in the far north of Australia and hunts for more land further south.

Among rivals there’s been talk – all on background only – that maybe it’s the winding up of Mrs Rinehart’s partnership with Shanghai CRED, her partner in the Kidman & Co cattle empire. That’s something the iron ore billionaire – not one to chat widely to the media – flatly denies.

“Multiple high-quality properties will still be retained by (Kidman),” Mrs Rinehart told The Weekend Australian. “Both parties are committed to retaining and continuing to support the iconic history of S. Kidman & Co and its legacy.”

This may be true but properties being sold – more than eight over the past 18 months – are connected to the Kidman joint venture while the ones being purchased are through her own company.

It’s also fair to say some Chinese real estate companies are under pressure to return capital back home amid the ongoing crisis in the country’s property industry, highlighted by the default last year of the nation’s second largest developer, China Evergrande Group.

The nation’s biggest cattle stations are currently the plaything of the super rich, with rival iron ore billionaire Andrew Forrest most recently on the losing side of a battle for control of the Australian Agricultural Company against Bahama’s-based Tottenham Hotspur football club owner Joe Lewis.

Mrs Rinehart is keen on the game. Instead of getting out of cattle, as some have suggested she might do, her moves could reflect her view on the future of water rights, animal rights and even the impact of climate change on properties in the north, says one rival producer.

This is a person whose business nous is frequently underestimated, despite being the richest in the land.

Mrs Rinehart inherited her iron ore tenements from her father, and because of this enviable inheritance, it’s often forgotten that she took Hancock Prospecting from near bankruptcy to one that’s made almost $20bn in profit in the past four years alone.

Now, Mrs Rinehart is changing her agricultural strategy at Hancock and the Kidman, owned through the joint venture known as Australian Outback Beef, to get bigger in the higher margin Wagyu beef market as well as Santa Gertrudis.

“We are looking to purchase more country in the eastern states with higher quality pastures and more consistent growth throughout the year,” said Mrs Rinehart. “This will help us to grow our numbers and develop our 2GR Fullblood Wagyu herd to an even higher standard.”

For the non-cattle initiated, this means that Mrs Rinehart is snapping up land that has water or irrigation suitable for finishing Wagyu cattle, which need to be locked up and fed grains and barley for at least 300 days before slaughter to give them high fat marbling.

With some 340,000 head of cattle at last count, Mrs Rinehart is Australia’s second largest producer of beef, and so her strategy of what cattle to run where has flow on impacts.

While rival Wagyu producers such as AACo might be pleased they are on the same track as Mrs Rinehart, the same cannot be said for Brahman producers.

The properties being sold by the Kidman joint venture are largely stations in the far north where Brahman cattle manage to roam and survive eating grass in extreme heat and dry conditions.

While she retains some 35,000 head of Brahman, the property sales signify a clear shift away from the live-cattle export market and burger-meat style beef that Brahman cattle usually produce.

Australia’s richest person – worth an estimated $34bn – won’t comment directly on what she thought of live-cattle exports but is known in the industry to be uncomfortable with the practice.

Live exports of cattle were briefly banned in 2011 after shocking footage emerged of Australian cattle being slaughtered inhumanely in Indonesian abattoirs.

Just last month, Agriculture Minister Murray Watt told a live export conference that the Albanese government “strongly backed” the live cattle industry.

That hasn’t stopped some, including cattle breeders themselves, questioning the ethics of continuing the practice as a result of the footage showing such cruelty.

“Brahman cattle have been favoured in the north due to their ability to survive northern conditions, but generally are most suited to the live export markets,” was all Mrs Rinehart would say on this issue. “They can also provide hamburger meat, but this faces competition from the growing non-meat alternatives.”

Whether her reasons are based on ethics or finances or both remains to be seen.

She does seem genuine in her views on animal welfare and says her stations and farms have had shading installed across yards, paddock shelters built, as well as new watering systems, yards and fences constructed.

“Animal welfare was and continues to be a major company-wide priority, we have on signs around our properties, “happy, healthy cattle are the best cattle,” reminding staff of our everyday animal welfare policy,” Mrs Rinehart said.

Rabobank senior animal protein analyst Angus Gidley-Baird says whether it be Wagyu or Brahman the outlook for beef is reasonably strong for the rest of this year and next, meaning there isn’t a clear reason to get out of one type of cattle in favour of another.

“We are seeing strong prices again in the Wagyu market,” said Mr Gidley-Baird. “It might seem counter intuitive given the commentary around softening economic conditions, but maybe that part of the consumer market is less affected by slowing economic conditions and can still afford the higher price premium product.”

Another attraction to Wagyu, Mr Gidley-Baird added, is that it’s a controlled product that isn’t subject to spot pricing because of the strict requirements around breeding and length of time the cattle need to be feedlotted before slaughter.

“If you do the Wagyu job correctly and you are part of a completely integrated supply chain you probably have a much better feel for where the product is going and what’s needed and feel like you are capturing more of the value in that chain,” Mr Gidley-Baird said.

As one of the largest exporters of Wagyu in the world, Australian producers are well positioned to manage pricing for their product, which is good news for Mrs Rinehart and AACo.

“So from an Australian position, you have a stronger ability to influence the market rather than be a price taker,” Mr Gidley-Baird said.

It’s a different story for spot price beef products which are more subject to supply issues in other countries such as Brazil but can benefit from factors such as the decline in the domestic herd in the US, the world’s second largest beef importer.

“If you are producing a commodity traded product, you’re competing against a lot of other people,” said Mr Gidley-Baird.

Whatever Mrs Rinehart’s reasons it’s undoubtedly been a good time to have been offloading the Kidman properties as prime stations continue to sell for top dollar.

Col Medway, co-founder of rural real estate agents LAWD, told The Weekend Australian that property prices for agricultural lands are continuing to rise.

“We’ve had double digit year on year growth now for four years,” Mr Medway said. “We are at new highs but ag land never really goes backwards so nearly every year it’s a record high.”

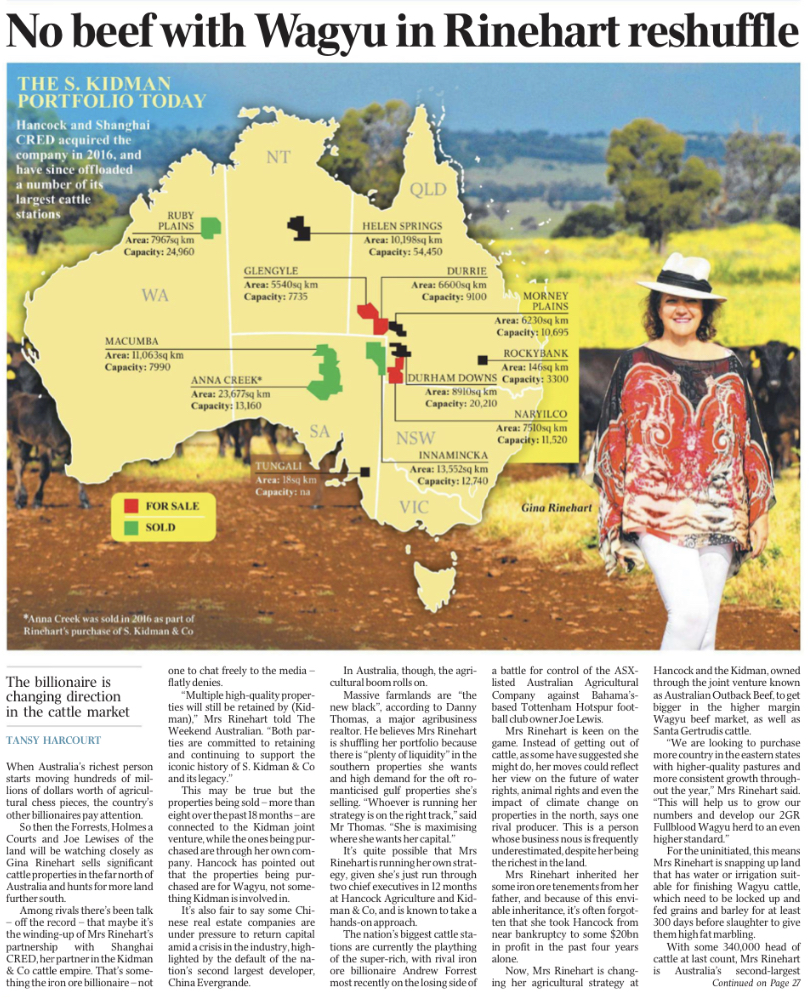

Currently on the block out of the Kidman joint venture are Brunchilly on the Barky Tablelands in the Northern Territory as well as Glengyle, Durrie and Naryilco in southwest of Queensland. These properties are rumoured to be close to being sold and have a total land-area of 24,182sq km and have the capacity to run more than 45,000 head.

Over the past 18 months Kidman & Co has sold at least eight cattle stations including Riveren and Inverway in the NT for $105m, a big jump from the $60m it paid a few years earlier, as well as Aroona, Willeroo, Sturt Creek and Ruby Plains in Western Australia, and Innamincka and Macumba stations in South Australia.

The sales in total are understood to have brought in more than $250m.

Kidman & Co no longer has any assets in WA or SA, and following the sale, according to the assets listed on its website, will have one station in the NT and three in Queensland.

Despite big names such as Mrs Rinehart being in the news for buying massive landholdings, Mr Medway said much of the demand was coming from farmers.

“It’s been the larger, stronger family farming business seeking expansion opportunities,” Mr Medway said. “Institutional investors and high-profile people like Mrs Rinehart and Twiggy Forrest and the like, they get a lot of centimetres in the paper but they are certainly not driving this market – they are participants only.”

Perhaps it’s the high prices that has meant Mrs Rinehart has been taking a slow approach to purchases that suit her desire to grow her Wagyu operation.

Just a few months ago, she purchased three irrigated cropping farms near Wee Waa in NSW for a rumoured price of $150m and earlier in the year purchased a Warra Warra cropping property across the border in Queensland.

In 2018 she purchased Armidale’s Sundown Valley, a highly regarded backgrounding and finishing operations – as well as the Gunnee feedlot near Inverell.

Two years prior she purchased a specialist Wagyu feedlot in Warwick, in southern Queensland.

The billionaire’s Wagyu operation now spans from breeding, to grazing, feedlotting, slaughter and boxed beef sales and the whole beef operation this past year posted a $42m profit.

It might fall a tad shy of the $3.2bn profit earned from Hancock’s Roy Hill iron ore mine last year but Rinehart seems very committed to Australian agriculture.

“Australia has agricultural people and farmland that are capable of producing premium food products,” said Mrs Rinehart. “As food security becomes more critical, the ability to consistently supply food will mean that pastoral lands should become more important.”

Please find the print version below.